operating cash flow ratio industry average

Average industry financial ratios for US. The formula to calculate the ratio is as follows.

How To Do A Cash Flow Analysis With Examples Lendingtree

On the trailing twelve months basis Oil And Gas Production Industry s ebitda grew by 5034 in 2 Q 2022 sequentially faster than total debt this led to.

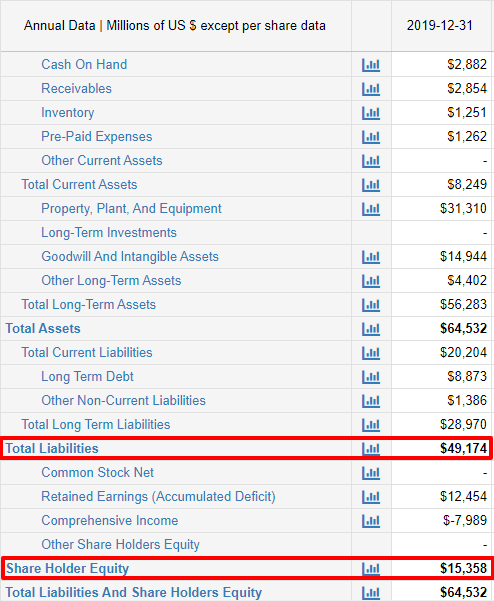

. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula. Debt Coverage Ratio Comment. Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages.

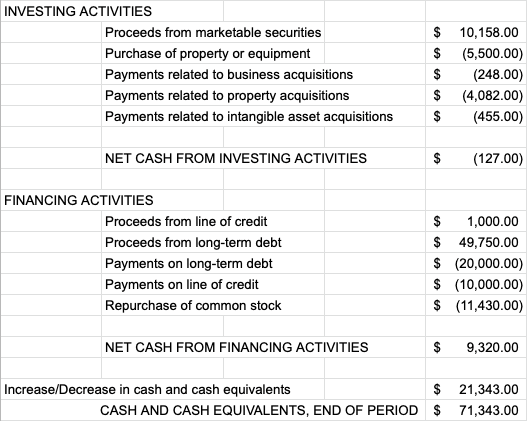

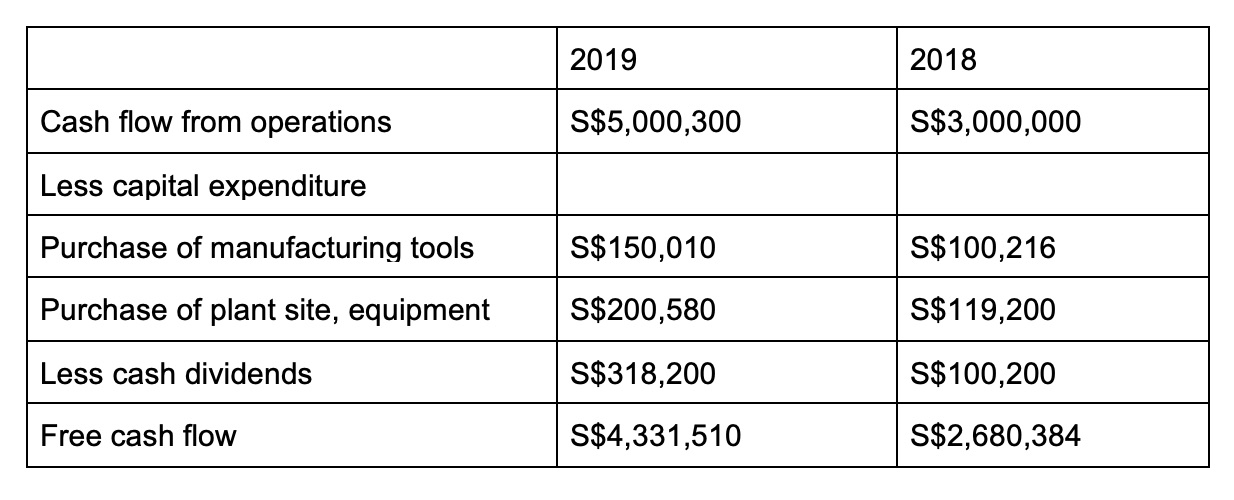

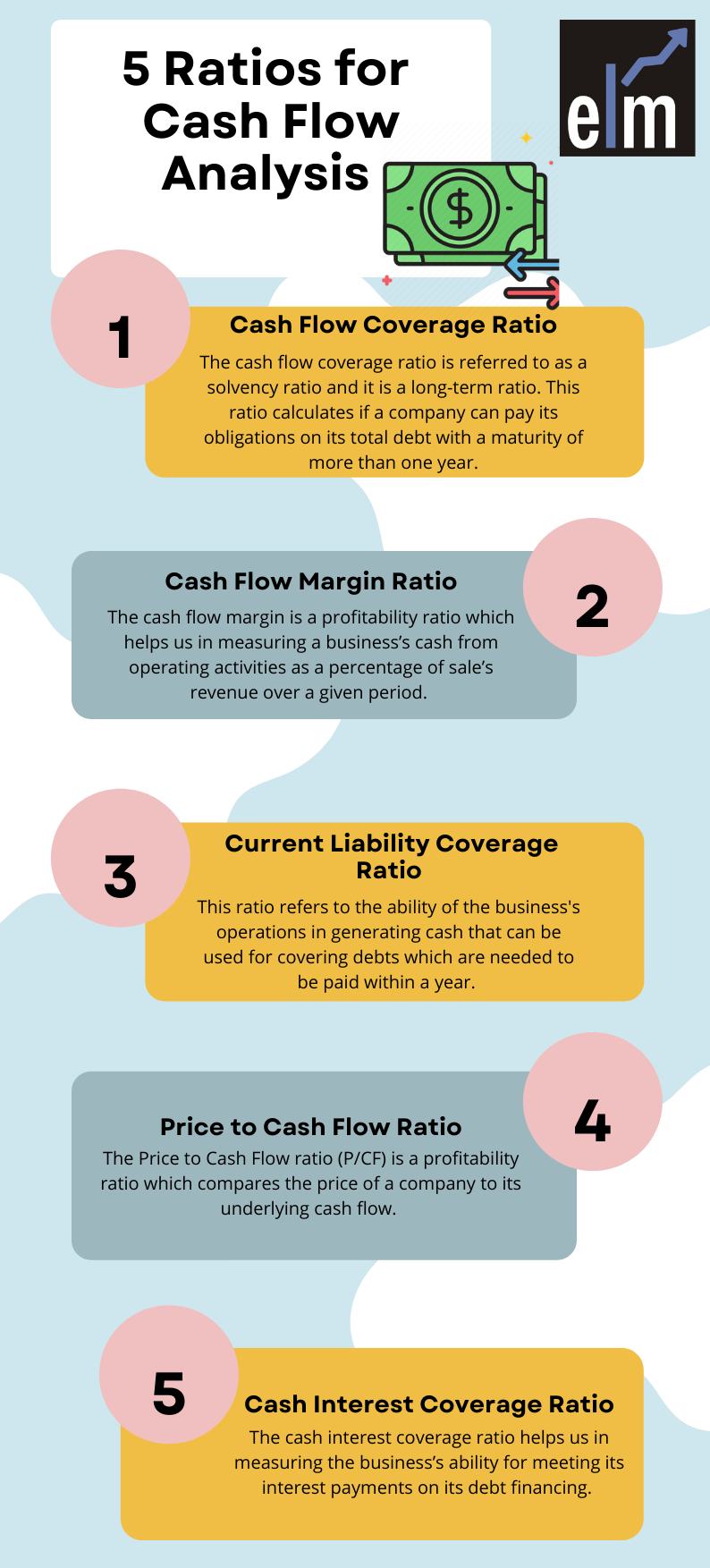

Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR. How to do a cash flow margin calculation. OCR Ratio Cash flow from operating activities Current liabilities.

To work out your companys operating cash flow margin youll need to know a couple of key pieces of information including net income and. Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance.

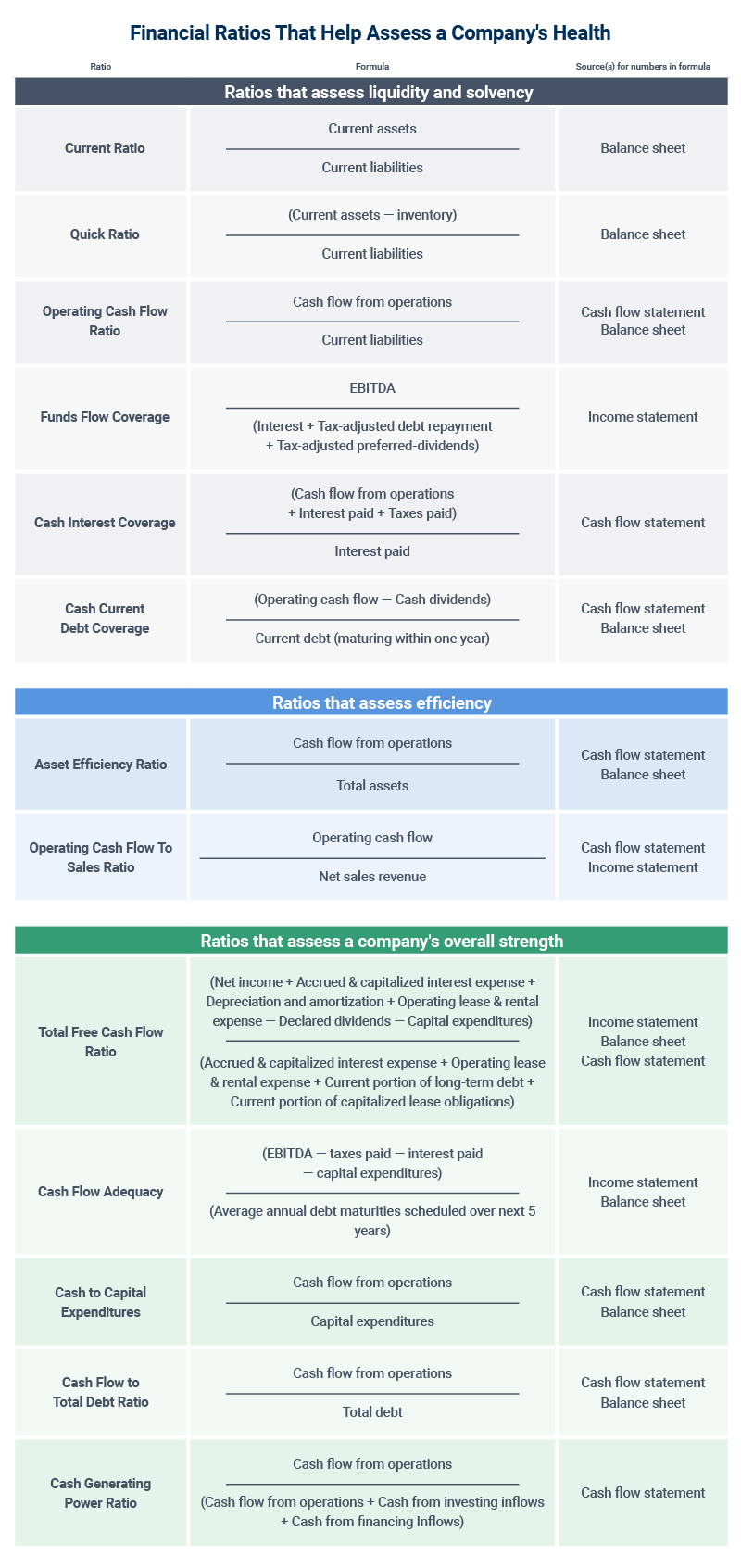

Liquidity Ratio Formula And Calculation Examples Cash Flow Per Share Formula Example How To. 220 rows Operating cash flow ratio Operating cash flow. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

Cash ratio is a refinement of quick ratio and. In other words SMCs cash balance was 75x its debt. In this case the.

Operating cash flow ratio industry average Sunday July 24 2022 Edit. Restaurants Industry experienced contraction in Operating Profit by -2764 and Revenue by -602 while Operating Margin fell to 998 below Industrys average Operating Margin. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

75 rows Cash Ratio - breakdown by industry. Operating Cash Flow. Operating Cash Flow Ratio.

872 975. A higher than industry.

Free Cash Flow What This Metric Tells You About A Company S Financial Health Standard Chartered Singapore

5 Important Ratios For Effective Cash Flow Analysis Elm

Financial Metrics Master The Language Of Business

What Is Operating Cash Flow Ratio Guide With Examples

Earnings Quality Financial Edge

5 Important Ratios For Effective Cash Flow Analysis Elm

What Is Operating Ratio Freightwaves

Debt To Equity Ratio Macrotrends

Solved Net Cash Provided By Operating Activities Information Chegg Com

Fsa Cabrera Pdf Dividend Bonds Finance

Cash Flow Coverage Ratios Aimcfo

Price To Cash Flow P Cf Formula And Calculator

Leverage Ratio What It Means And How To Calculate It

Operating Cash Flow Basics Smartsheet

7 Cash Flow Ratios Every Value Investor Should Know

Can Fund Shareholding Inhibit Insufficient R D Input Empirical Evidence From Chinese Listed Companies Plos One

Managing Mining Cash Flows Mckinsey